Leave Your Message

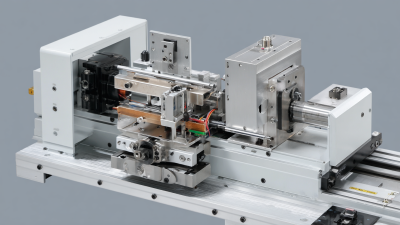

As the 2025 China Import and Export Fair approaches, companies in the Ultrasonic Welder Factory sector are poised to explore a myriad of growth opportunities that could reshape the industry landscape. This esteemed event, known for showcasing the latest innovations and connecting buyers and sellers, provides a unique platform for manufacturers, suppliers, and investors within the ultrasonic welding market. With the increasing demand for efficient and sustainable welding solutions across various sectors such as automotive, electronics, and textiles, ultrasonic welders are becoming essential tools in modern manufacturing. The fair not only highlights the latest technological advancements but also emphasizes collaboration and strategic partnerships that can enhance market competitiveness. As stakeholders gather to discuss future trends and challenges, the Ultrasonic Welder Factory sector stands at the forefront of industrial evolution, ready to leverage insights and forge pathways for sustainable growth in an ever-evolving global marketplace.

The ultrasonic welding technology market is poised for significant growth by 2025, driven by advancements in manufacturing processes and an increasing demand for quality and efficiency across various industries. According to a report by Allied Market Research, the ultrasonic welding equipment market is expected to reach approximately $1.3 billion by 2025, growing at a CAGR of 6.8% between 2019 and 2025. This growth is largely attributed to the widespread adoption of ultrasonic welding in sectors like automotive, electronics, and medical devices, where precision and reliability are paramount.

Moreover, the shift towards automation and smart manufacturing is further enhancing the appeal of ultrasonic welding technologies. The ability to join materials quickly and without the need for additional adhesives, which can compromise product integrity, positions ultrasonic welding as a preferred method in modern manufacturing environments. A study by MarketsandMarkets highlights that the increasing adoption of automation in factories is expected to drive the demand for ultrasonic welding machines, especially in high-volume production processes. As businesses seek to improve operational efficiency and reduce costs, ultrasonic welding technology presents a compelling solution that aligns with future market trends.

| Region | Market Size (Million USD) | CAGR (%) | Key Application Areas | Technological Advancements |

|---|---|---|---|---|

| Asia-Pacific | 450 | 10.5 | Automotive, Electronics | Smart Ultrasonic Technology |

| North America | 320 | 8.2 | Medical Devices, Packaging | Advanced Control Systems |

| Europe | 380 | 7.5 | Aerospace, Consumer Goods | High-Power Ultrasonic Welders |

| Latin America | 150 | 9.0 | Textiles, Construction | Portable Ultrasonic Welders |

| Middle East & Africa | 90 | 6.0 | Construction, Medical Supplies | Hybrid Ultrasonic Systems |

The ultrasonic welder market in China is poised for significant growth, particularly within the diverse manufacturing sectors. According to recent industry reports, the demand for ultrasonic welders is projected to increase by over 15% annually from 2023 to 2027. This surge can be attributed to the rapid development of industries such as automotive, electronics, and packaging, where precision welding is crucial for ensuring product integrity and durability. For instance, the automotive sector alone is expected to account for approximately 25% of the ultrasonic welder market by 2025, driven by the need for lightweight materials and enhanced manufacturing processes that require reliable bonding methods.

Furthermore, as China continues to focus on advanced manufacturing techniques, the adoption of ultrasonic welding technology is gaining momentum. A report by MarketsandMarkets estimates that the total market for ultrasonic welding equipment in Asia-Pacific will reach $1.2 billion by 2026, with China being the key contributor. This is largely due to the increasing automation within factories and the demand for higher quality products, which necessitates the use of advanced joining technologies. As manufacturers seek to improve efficiency and reduce costs, ultrasonic welders are becoming an essential tool in the production line, highlighting a critical shift towards innovative manufacturing practices in China.

The ultrasonic welder industry is witnessing significant advancements and a rising interest among key players, particularly as the 2025 China Import and Export Fair approaches. Companies specializing in ultrasonic welding technology are innovating to enhance efficiency, reduce energy consumption, and expand the range of materials that can be joined using ultrasonic methods. Innovations such as automated robotic systems integrated with ultrasonic welding technology are becoming increasingly prevalent, demonstrating the industry's commitment to advancing manufacturing processes.

Key players in the ultrasonic welder sector are likely to showcase their latest products and solutions at the fair, creating an opportunity to engage with a global audience. Manufacturers are also investing in research and development to improve the precision and versatility of their welding machines. Notable companies are collaborating with tech firms to explore the integration of artificial intelligence and IoT capabilities in ultrasonic welding, aiming to streamline operations and enhance quality control. These developments signify a competitive landscape that is set for significant growth in the near future, positioning the ultrasonic welder factory sector as a prominent player in the industrial automation market.

The ultrasonic welder sector is witnessing significant transformations, particularly as we approach the 2025 China Import and Export Fair. One of the principal competitive advantages in this industry is the ability to offer precision and efficiency in welding processes. Ultrasonic welders are known for their minimal thermal impact and enhanced material bonding, making them a preferred choice in sectors like automotive, electronics, and medical devices. However, companies must navigate the challenges posed by rapid technological advancements and fluctuating market demands.

To maintain a competitive edge, manufacturers should focus on continuous innovation and customer-centric solutions. This involves investing in R&D to harness the latest technologies and adopting flexible manufacturing processes that can adapt to diverse client needs. Additionally, establishing strong partnerships with suppliers can enhance the supply chain efficiency, reducing costs and improving product quality.

Tips: Regularly assess the market trends and technological developments to identify areas for improvement and potential collaborations. Engage with customers to understand their pain points, which can inform product development and marketing strategies. Lastly, consider sustainability practices that not only comply with regulations but also resonate with environmentally conscious consumers.

The 2025 China Import and Export Fair presents a prime opportunity to analyze the export prospects for

ultrasonic welders, particularly in light of China's cyclical dependence on industrial exports.

As global markets calibrate their needs towards advanced manufacturing technologies, ultrasonic welders—essential for bonding dissimilar materials—are gaining traction.

This melds with China's ongoing strategy to enhance its production capacity while navigating a complex economic landscape.

Tips: To capitalize on export opportunities, businesses should focus on aligning their product offerings with industry-specific demands.

Engaging in market research to identify key trends in manufacturing sectors that utilize ultrasonic welding can provide valuable insights.

Furthermore, fostering relationships with international buyers at the fair could potentially facilitate partnerships that extend beyond mere transactions.

With the backdrop of a stimulus-driven economy that emphasizes manufacturing over consumption,

the fair is poised to provide insights into how ultrasonic welding technologies can cater to both domestic and global markets.

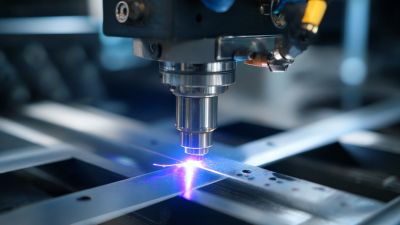

Keeping tabs on technological advancements in related equipment—such as laser cutting machines—might also yield innovative synergies that enhance product competitiveness.